Our extensive expat guide offers crucial information about moving and living in France, covering topics like visas and residency, healthcare, housing, cost of living, cultural highlights, and various other aspects of relocating and establishing a life in the country.

In this guide:

- The legalities of moving to France: visas and residency options for non-EU nationals.

- The cost of living: monthly expenses, rentals, and real estate.

- France as a retirement destination.

- Infrastructure: travel connections, public transport, internet.

- Healthcare: your options, health insurance.

- Taxes and bank accounts.

- Where to live in France – an overview of the most popular expat locations.

France’s highlights

- Attractive lifestyle: France offers an excellent lifestyle for families and retirees as the focus is on the quality of life.

- Diverse climate and landscapes: Diversity in terms of landscape and climate means that you can mountaineer in the Alps of Auvergne-Rhône-Alpes and then head to the Med and soak up the sun on the French Riviera while northern Europe suffers under heavy grey skies.

- Affordable property and cost of living: France is reasonably affordable if you take Paris out of the equation. More rural areas can feel positively cheap when it comes to real estate.

- Good quality healthcare and education.

- Good travel connections with the rest of the world.

- Rich and diverse cultural experience: The French love and appreciate fine art, architecture, good food and wine, fashion, and style. Living in France means enjoying the cultural experience, which is unique and very distinctive.

Residency in France for non-EU nationals

Depending on your home country’s agreement with France, you might be able to enter the country without a visa – check the French government site for this.

UK, Canadian, and US citizens can stay in France for up to 90 days in 180 days without any visa.

To stay in France for over three months, you must apply for a long-stay “visitor” visa, VLS-TS.

This visa, which is valid for one year, allows you to enter and stay in France for the entire duration without applying for a residence permit from the Préfecture. You need, however, to validate your visa electronically upon arrival.

After the initial year of residing in France, you must apply for the appropriate residence permit.

Applying for the VLS-TS visitor visa

- You must apply for a visa in your home country before moving to France.

- Income Requirement: a monthly income equal to or greater than France’s minimum wage (SMIC), approximately €1,250 net (€1,500 gross) per month, or around €2,000 for a couple.

- This income can be your pensions, rental income, investment, or other financial resources, but not income from work.

- Present private health insurance that covers you for the duration of your stay in France.

- Submit a declaration stating that you won’t undertake paid work while in France.

Validating the VLS-TS visitor visa

Your visa must be validated within three months of arriving in France. It’s an online process done through the government website.

Before you start, make sure you have the following:

- Personal information: email, address in France, telephone number, etc.

- Your visa information: visa number, date of beginning and end of validity, date of issue, reason for stay

- A bank card to pay a €50 fee.

Long-stay visa and residency for retirees

If you plan to fully retire to France, you need to apply for the VLS-TS visitor visa and go through the steps we mentioned above. This type of visa means you formally agree not to engage in any form of paid work while living in France.

However, if you are planning “halfway retirement”, such as setting up a B&B or other small business, you will still need a working visa. You’ll need to supply plenty of information about the financial viability of your proposed business, and there’s a greater chance of rejection.

Steps to take to obtain French residency:

- Apply for a 1-year long-stay visa in your home country.

- Apply for a temporary and/or multi-year Carte de Séjour (residency card) when in France.

- After five years of residence in France – a Carte de résident permanent (permanent residency card).

If you’re planning to retire to France permanently, you’ll need to apply for a carte de séjour at your local préfecture. This process is much like the visa application and will require much of the same information about your living and financial situation.

Providing your application is successful, your first carte de séjour will last five years, after which you’ll need to apply for another one.

A word about the application process in your local prefecture

As mentioned, this process is carried out at your local prefecture, an administrative office belonging to the Ministry of the Interior, which is in charge of things like identity cards, driving licenses, passports, residency, work permits for foreigners, etc.

Each of the 101 departments in France has one, and it is the place to go to manage everything from establishing your residency to registering your driving license.

While requirements and standards should be universal across France for registering your presence, subtle differences in interpretations of the rules are present. Approach your local préfecture with an open mind and ask for details of what you must do to legitimize your presence in France.

If all of this sounds a bit confusing and long-winded, you’re not alone in your opinion. Luckily there are companies that offer ‘relocation services”. These are firms based in France that specialize in helping residents of other countries with the application process.

While it might seem like an extra cost, the price is more than justified in the amount of time and stress it will save you, particularly if you’re organizing moving house alongside.

Alternative ways to residency in France

France currently offers two different business investor visa programs.

The first is the business investor talent passport, which requires an investment of €300,000 in French business.

The other, the French residency program, is aimed at high-net-worth individuals and requires an investment of €10 million in French business.

French residency program

The Golden Residency program is aimed at those with significant business investment interests in France. By investing €10 million in industrial or commercial assets, you gain a 10-year residency permit for you and your immediate family.

This entitles you to all the benefits of French residency: access to healthcare, social welfare (not that you’d probably need it!), and visa-free travel within the EU. What’s more, the application process only takes two months.

France’s Business Investor Talent Program

Perhaps the more realistic option is the business investor talent passport. This is a sub-group of the long-stay visa, meaning you still have to go through the same initial process as everyone else.

However, as part of the process, you make a direct investment of €300,000 in French business and commit to protecting or creating jobs over a four-year period. You will then be able to gain a four-year residency permit that’s renewable based on reassessment.

This permit then grants you access to residency status. However, unlike the Golden program, it doesn’t cover your immediate family. Instead, they will have to apply for a family residence permit alongside your application.

Whichever you choose, a business investor visa certainly speeds up the process. The easiest of the two options is the golden residency permit. However, if you don’t have that kind of capital, the business investor talent passport will still grant you much quicker access than the standard application process.

The cost of living in France

On average, France is not the cheapest country in Europe. Unlike Portugal, Cyprus, or Spain, France is not the best value-for-money retirement destination.

However, the average figures are greatly distorted by Paris, one of the most expensive cities in the world.

Here’s how France compares to some Northern European and North American countries:

Monthly expenses

- Groceries: a typical monthly budget for a single person is around €250 to €350.

- Utilities: electricity, heating, cooling, water, and garbage can range from €100 to €200.

- Dining out: from around €15 to €30 per person in a basic cafe to €50 to €100 in a reputable restaurant.

- Internet: a monthly internet subscription typically costs €30 to €40.

- Mobile: monthly mobile phone plans can range from €10 to €30, depending on usage and data allowances.

- Public transportation: public transport in major cities like Paris may cost around €70 to €85.

Housing

Paris is the most expensive city in France when it comes to real estate and rent. However, it is possible to find affordable accommodation outside of Paris, even in the most popular urban areas.

Here’s an average housing cost in various cities in France:

| Area | Average cost of property (EUR) | Average rent (EUR) for an unfurnished 1-bed apartment |

|---|---|---|

| Paris | 1,035,000 | 1,600 |

| Lyon | 435,000 | 900 |

| Marseille | 320,000 | 750 |

| Bordeaux | 410,000 | 800 |

| Nice | 650,000 | 1,200 |

| Toulouse | 330,000 | 700 |

| Nantes | 310,000 | 650 |

| Strasbourg | 275,000 | 600 |

| Montpellier | 290,000 | 700 |

| Grenoble | 260,000 | 600 |

These figures are approximate and can vary depending on location, property size, and current market conditions.

Renting in France

Here’s a list of documents you typically need to rent a home in France for a long-term period:

- A valid passport or national ID card to verify your identity.

- Proof of address.

- Proof of income: recent pay stubs, employment contracts, bank statements, or tax returns.

- Employment or study details: an employment contract or acceptance letter from a university.

- References from previous landlords or rental agencies, if available.

- French guarantor: in some cases, landlords may require a French guarantor who is willing to take responsibility for rent payment if you default. They will typically need to provide proof of income and an ID.

- Proof of insurance: depending on the property, you may be asked to provide proof of home insurance that covers liability and damage.

- Completed rental application form provided by the landlord or rental agency.

It’s standard to pay a security deposit as well as one month’s rent in advance.

Your tenancy agreement is called a bail or “contrat de location“.The minimum duration for a tenancy is three years for an unfurnished home and a year for a furnished property.

Agreements for only a year for an unfurnished home can be established in some circumstances. It is really important to know what you’re signing up for, to discuss it in advance with your landlord, and to understand under what criteria you can break the contract if you decide to move on or buy your own home.

Our guide to Renting A Property In France will provide you with all the information about the rental process in France and how to protect your rights as a tenant.

If you want to buy a property in France, the process is relatively straightforward, although it is said that if you have a basic knowledge of French, you’re in a more vulnerable position than if you have no French at all.

A Complete Guide To Buying A Property In France – a step-by-step guide to purchasing a property in France, legalities, due diligence, paperwork, legal protection, representation, etc.

France as a retirement destination

France’s distinct lifestyle offsets the relatively high cost of living, and it’s exactly why France is one of the best countries to retire abroad.

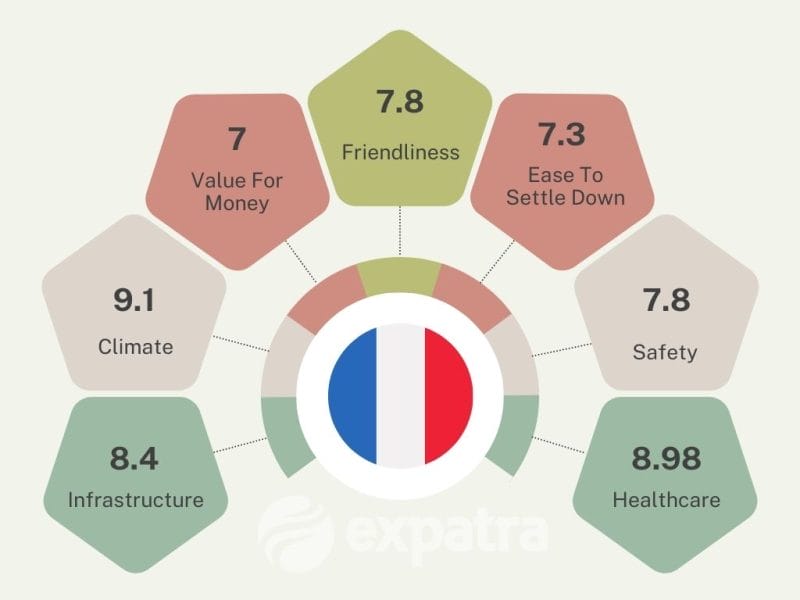

According to the Expatra Global Retirement Index, France scores very high as a retirement destination.

The index is based on the Expatra Global Retirement Survey that asks international retirees to rate their retirement destination’s infrastructure, climate, ease of settling down, value for money, friendliness, and other aspects of life in their retirement destination.

Here’s how France scores:

How much money do I need to retire to France?

Officially, to qualify for a long-stay visa, your monthly income should be equivalent to the ‘SMIC’ (minimum wage in France). Starting May 2023, the minimum wage in France for an adult over 23 years is €1 747,20 per month.

This represents an annual gross salary of €20,967. However, in reality, it’s not that straightforward.

Decisions are taken on a case-by-case basis, and several other factors are considered. These include your savings and whether you rent or own your property.

A couple in retirement that needs a one-bedroom apartment can expect to pay anywhere up to €1,900 a month, depending on where they settle down.

Then, of course, is your choice of lifestyle. The more you plan on eating out and taking part in social activities, the more money you will need. A retired couple wanting a good social life without any money worries will probably need a monthly income of around €2,300.

A flat tax rate on the lump sum pension

In France, there is theoretically the option of taking your entire pension out in one lump sum and only paying a 7.5 percent tax on it. For those for whom an entire pension withdrawal will mean they are pushed into the highest tax bracket, this makes incredible sense.

In France, lump sums from pensions are not taxed at marginal rates but are only subject to a 7.5 percent income tax charge, no matter how big the withdrawal is. You can find more information on this in our Expat Guide To UK Pensions Abroad.

To qualify, you would have to establish tax residency in France before taking your lump sum, and you would have to take expert advice to ensure your understanding of the rules and that they apply in your case.

International travel links

France is well-connected internationally and is a very convenient location for traveling around Europe and globally.

International flights

Major international airports such as Charles de Gaulle Airport (Paris), Nice Côte d’Azur Airport (Nice), and Marseille Provence Airport (Marseille) provide direct flights to cities across Europe, Asia, Africa, the Americas, and Oceania.

Trains

The high-speed train network, known as the TGV (Train à Grande Vitesse), links major French cities, such as Paris, Lyon, Marseille, and Bordeaux, with international destinations like Brussels (Belgium), Amsterdam (Netherlands), Geneva (Switzerland), and Barcelona (Spain).

Ship routes

The Port of Marseille-Fos (Marseille), Port of Le Havre (Normandy), and Port of Calais (Calais) offer ferry connections to various destinations, including the United Kingdom, Ireland, North Africa, and other European countries.

Public transport

In major cities of France, public transportation is well-developed, and it is quite possible and much easier to live without a car.

| Mode of Transport | Description | Average Cost |

|---|---|---|

| Train | Connects major cities and towns across the country. | €30-150, depending on distance and type of train |

| Metro | Only in major cities such as Paris, Lyon, Marseille, and Toulouse. | €1.50-3 per ride |

| Bus | Used for both short and long-distance travel and cover routes that may not be served by trains. | €5-30, depending on distance and region |

| Tram | Available in many French cities, including Bordeaux, Nice, and Strasbourg. | €1.50-3 per ride |

| Bicycle-sharing | Many cities offer bicycle-sharing programs and dedicated bike lanes. | €1-5 per hour or €10-30 per day, depending on the city |

However, this is not the case in more rural settings.

Public transport between the smaller villages is basically non-existent. There are trains only between major towns, and the buses aren’t great. You’ll need your own transportation from day one.

Where to live in France

If you’re considering this great and beautiful land as a place to call home, here is a review of the most popular regions among expats.

Affordable areas in France

Going a bit more rural, you will find that both renting and buying a property in France will cost you much less than in North America, northern Europe, or the UK, and monthly living expenses will be quite affordable.

Currently, the cheapest place to live in France is between Franche-Comté and Limousin.

Both areas are quite sparsely populated comparatively, and you can pick up an inexpensive renovation project for as little as €50,000. Depending on the type and condition of the property, the price per square meter is roughly €1,700.

Away from the coast is also cheaper. For example, you will find that the cost of living in the Dordogne will be lower than in your home country, while the quality of life will be much higher.

Go further inland to Burgundy, and you will find a very affordable and greatly enjoyable lifestyle for retirement.

The best things in France, such as the weather and nature, come free anyway.

Here is how the most popular regions for expats in France compare in climate and the average property price:

| Region | Climate | Average Property Price | Further information |

|---|---|---|---|

| Alsace | Cool winters, mild summers | €200,000 – €400,000 | |

| Nouvelle-Aquitaine | Mild winters, hot summers | €250,000 – €500,000 | Living in the Dordogne |

| Auvergne-Rhône-Alpes | Cold winters, mild summers | €150,000 – €300,000 | Living In Auvergne-Rhône-Alpes |

| Brittany | Mild winters, cool summers | €200,000 – €400,000 | Living in Brittany |

| Bourgogne-Franche-Comté | Continental weather with hot summers and cold and long winters | €250,000 – €500,000 | Living in Burgundy |

| Corsica | Mild winters, hot summers | €300,000 – €600,000 | |

| Île-de-France | Mild winters, warm summers | €400,000 – €800,000 | Living in Paris |

| Languedoc-Roussillon | Mild winters, hot summers | €250,000 – €500,000 | Living in Montpellier |

| Loire Valley | Cool winters, mild summers | €200,000 – €400,000 | |

| Midi-Pyrénées | Mild winters, hot summers | €250,000 – €500,000 | |

| Normandy | Mild winters, cool summers | €200,000 – €400,000 | Living in Normandy |

| Occitania | Mild winters, war summers | €200,000-€400,000 | Living in Toulouse |

| Poitou-Charentes | Mild winters, warm summers | €200,000 – €400,000 | |

| Provence-Alpes-Côte d’Azur | Mild winters, hot summers | €300,000 – €600,000 | Living in Provence Living in the French Riviera |

If you want to narrow down the choice to exact locations, our Best Places to Live in France guide will make an excellent starting point.

Taxes in France

When you move permanently to France, you become a French tax resident. It means your worldwide income has to be declared in France and is potentially taxable in France.

Here are the main taxes French residents must pay:

- The income tax in France is progressive and divided into several tax brackets, ranging from 0% to 45%. The rates vary depending on the amount of income earned.

- Value Added Tax (VAT): Also known as TVA (Taxe sur la Valeur Ajoutée), VAT is a consumption tax applied to most goods and services in France. The standard rate is 20%. However, there are reduced rates for certain items like food, transportation, and cultural goods.

- Property Tax: Property tax, known as Taxe Foncière, is levied on the owners of real estate properties in France. The rates are determined by local authorities based on the property’s market value.

- Wealth Tax: Formerly known as Impôt de Solidarité sur la Fortune (ISF), it has been replaced by the Impôt sur la Fortune Immobilière (IFI). This tax applies to individuals whose net worth exceeds a certain threshold. The rates range from 0.5% to 1.5%.

- Social Security Contributions: French residents are required to contribute to social security, which funds various social benefits and healthcare programs. The rates depend on the type of income and are typically shared between employees and employers.

- Capital Gains Tax: When selling certain assets like real estate and stocks, individuals may be subject to capital gains tax. The rates vary depending on the type of asset and the duration of ownership.

- Inheritance and Gift Tax: In France, inheritance and gift tax is applicable on the transfer of assets between individuals. The rates depend on the relationship between the donor and the recipient.

- Local Taxes: Local taxes, such as taxe d’habitation (residence tax) and taxe foncière (land tax), are collected by local authorities to finance public services and infrastructure in the region.

France is not a low-tax country; however, employing a professional accountant can help significantly with optimizing your taxation. For more details, visit our guide to Taxes in France.

Banking and bank accounts in France

Here’s a list of documents typically required to open a bank account in France:

- Identity proof: A valid passport or national identity card.

- Proof of address: A recent utility bill, rental contract, or bank statement showing your current address in France.

- Proof of income: Recent pay slips, employment contract, or tax return to demonstrate your source of income.

- Residence permit: If you are a non-EU citizen, you may need to provide a valid residence permit or visa.

- Proof of employment: A letter from your employer or proof of self-employment.

- Social Security number: If you have one, provide your French Social Security number (Numéro de Sécurité Sociale).

- Reference letter: Some banks may require a reference letter from your previous bank.

Non-resident bank account

It’s possible to open a French bank account even before you become a resident in France, although it’s easier to do so once you have established residency.

If you open an account pre-residency, then you will have fewer choices of banks willing to accommodate you, and you will have to abide by tougher criteria, such as minimum account balance. So, if you need a French bank account before you move, look for French banks that offer non-resident accounts (compte non-resident).

When opening a resident bank account, make sure you know the charges.

It is becoming more common for French banks to charge for accounts and certainly to charge for various types of services and transactions. Ask about the charges you will incur on a current account with debit card access in advance before opening an account.

Find more information in our guide to opening a bank account in France as an expat.

Healthcare in France

While applying for a visa and residency, you will need private health insurance. After becoming a resident, you have three options:

- Joining a state-funded health insurance scheme

- Finding local private health insurance

- Opting for international health insurance

State healthcare system

The healthcare environment in France is world-class. It is funded by social contributions and co-payment at the point of contact.

The healthcare system (l’Assurance Maladie) is primarily funded via the health insurance scheme Protection Universelle Maladie (PUMA).

PUMA grants an automatic and continuous right to healthcare in France to all legal residents in the country.

Joining PUMA is almost unavoidable when you become a resident of France.

It is a bit more complicated for early retirees as there’s a failure point in the existing French law.

According to the law, any legal resident can join PUMA after three months living in France. However, it is five years for early retirees.

Tip: Britons of retirement age in receipt of the state pension can access healthcare in France at a very low cost. If you are eligible for the UK-issued S1 form, you will join PUMA for no charge, purely for an administrative reason.

Private health insurance

Many regions in France have local mutual insurance companies, Mutuelles, that offer health coverage. It mostly serves as an addition to your PUMA coverage. Costs can vary significantly based on the specific mutual and the level of coverage, but some basic plans may start at around €20 to €40 per month.

Many expats opt for international health insurance. To make sure you get the best value for money, compare international health insurance options from various providers to find the best deal.

You will find all the information on healthcare in France, how to access the French healthcare system, register your S1 form, other options, private health insurance in France, etc., in our guide to Healthcare In France For Expats.

Getting connected in France

Telephone, mobile, internet, and TV are all vital ingredients of the modern lifestyle.

In France, there are a few big companies providing phone and internet services. The biggest are Orange (formerly France Telecom), Bouygues Telecom, Free Mobile, and SFR.

If you want, you can get all four services (landline, internet, mobile plan, and TV) from one provider, which makes managing those services easier.

It also makes sense to have a look at Free. The company offers fixed, mobile, and Internet services with low rates for international calls.

When getting your landline, you will need to provide the following:

- Your ID;

- Proof of address: a recent electricity bill, a tax bill, or a rental contract.

If broadband is very important to you, make sure you run a remote test before you sign up for any offers. You can use Degroup Test site for testing.

Final thoughts on living in France

Moving abroad is a big step. Moving to France might seem easy, but France can be a tough country to crack.

If you plan well, you will get it right, and you can live the dream.

PS. Most importantly – learn French!

You might find useful:

- The Best Places to Live in France – a detailed overview of France’s most popular locations for expats.

- The Guide To EU Golden Visas – Essential reading if you’re looking for a way to gain EU residence quickly

- The Expat Guide To UK Pensions Abroad – understand what options you have regarding your UK pensions, what happens to your state pension, and what you need to do to continue receiving your pension income without interruption when you move abroad.

- Ten Reasons To Retire To France – discover why France is such a popular expat retirement destination.

- The Essential Guide To Cost-Effective International Removals – read about international removals options and how you can keep your costs down while getting a quality service.

- Didn’t find what you were looking for or need further advice? Comment with your question below and we will do our best to help.

Helpful external links:

- Detailed info about visas on the government website.

- Government resource for foreigners in France

I am a UK citizen and have applied for dual citizenship (passport) with an EU country (Latvia). If successful, can I just go and live and work in France without the need to apply for a longterm visa?

Hi Martin, when you become a full Latvian citizen, you can live and work in any country within the EU including France. You won’t need a visa, all you will need to do is to register with the local authority and get a carte de séjour (residence permit).

Wow, this guide is great!

I really want to move to the Argeles Sur Mer area this year. I’m in Canada and I know I need a visa, which means signing a long-term rental agreement for an apartment there and getting a local bank account. Anyone know how I can get someone in that area to check out apartments for me, ensure the contract is good, make the deposit for me, take care of processing the contract and open a bank account for me? I’m 8000 km away!

I can do the proof of income and health insurance myself but I think I need someone on the ground for the other requirements.

I’m hoping there’s expats in the area that do this kind of thing:) Of course I’d happily pay for it.

My husband and i would like to retire to france in 3 or 4 years time, we would of paid our mortgage and have funds in the bank, i am going to start learning french now as i think its polite, i dont want to retire in the UK lol i dont deal with stress very well so is it worth some stress lol? we want to do up an ol barn or something as hubby is very good and in the construction business here. am very excited

Sounds like a great plan. Good luck and all the best!

Hello,

Thanks for all the information included here. My wife and I plan to “hopefully” move to France within 5 years. I am a retired US military member with access to “Tri-Care Overseas” healthcare insurance. Anyway, how long do you suggest we give to start the paperwork? In 3 years which will give 2 years for approval? I have also started taking French classes. Do you believe this would increase the approval process if I can speak French?

Thanks and sorry for the long email.

@Alan Malone,

How exciting that you have plans to move to France within 5 years! Any idea on where in France you would like to live?

I would think a year is enough to do all the paperwork, but a lot depends on your situation and how you want to be registered here in France. I would need more details to give you a customized advice, because the system is different here in France than in other countries. The fact that you would speak French will not really increase the approval process, and all depends if you would keep a life in the States as well, so if you would buy a house here as a second home or really have nothing left in the States.

If I can help you with anything, don’t hesitate to contact me or have a look on my website.

http://www.mp-bourgogne.com

contact@mp-bourgogne.com

Best regards and good luck!

Marit Grotenhuis

I am EU citizen with right to free movement.Husband is British but as he is married to me has same rights. We live in UK but have 2nd home in France where we spend up to 6 months each year. He was refused a long stay visa on the grounds that he did not need one because of his status as spouse of EU citizen. Is this correct?

Hi Di,

If your husband has been refused a visa by the French consulate services, it makes sense to presume that their explanation is correct. Generally, a family member of an EU citizen doesn’t need a visa to enter an EU state if he/she comes from a country whose citizens do not need a Schengen visa to enter the EU, which applies to your husband. However, to stay longer than 3 months he needs to sort out his residency in France. The best way is to clarify this with EU Advice Service, you can find it here: https://europa.eu/youreurope/citizens/residence/family-residence-rights/other-family/index_en.htm. Use the ‘GET HELP & ADVICE’ button at the bottom of the page. Hope this helps

This is indeed a comprehensive guide for the one who is looking forward to move to France .France is indeed a beautiful place to live. One of my friend spoke to regarding buying a property in France and I believe this article will definitely be of some help and hence will be sharing this with him.